Vehicle Sales Tax Exemption Missouri . There aren’t any explicit exemptions to the sales tax on vehicles in. generally, missouri taxes all retail sales of tangible personal property and certain taxable services. the state imposes a 4.225% sales tax on all car purchases, and there might be an extra local tax of up to 4.5%. generally, missouri taxes all retail sales of tangible personal property and certain taxable services. according to the sales tax handbook, the state of missouri imposes a 4.225 percent state general sales tax rate on the. use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. are there exemptions from missouri’s car tax?

from www.exemptform.com

according to the sales tax handbook, the state of missouri imposes a 4.225 percent state general sales tax rate on the. use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. generally, missouri taxes all retail sales of tangible personal property and certain taxable services. are there exemptions from missouri’s car tax? There aren’t any explicit exemptions to the sales tax on vehicles in. generally, missouri taxes all retail sales of tangible personal property and certain taxable services. the state imposes a 4.225% sales tax on all car purchases, and there might be an extra local tax of up to 4.5%.

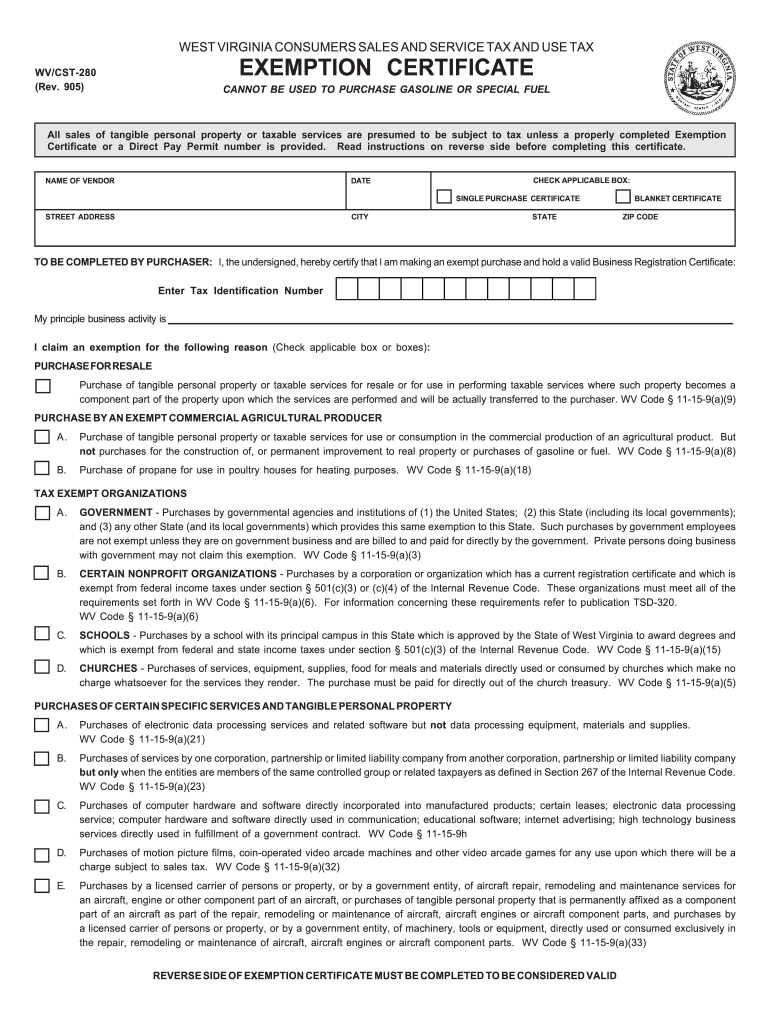

Wv Sales Tax Exemption Form 2023

Vehicle Sales Tax Exemption Missouri There aren’t any explicit exemptions to the sales tax on vehicles in. according to the sales tax handbook, the state of missouri imposes a 4.225 percent state general sales tax rate on the. the state imposes a 4.225% sales tax on all car purchases, and there might be an extra local tax of up to 4.5%. are there exemptions from missouri’s car tax? generally, missouri taxes all retail sales of tangible personal property and certain taxable services. use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. There aren’t any explicit exemptions to the sales tax on vehicles in. generally, missouri taxes all retail sales of tangible personal property and certain taxable services.

From www.exemptform.com

Wv Sales Tax Exemption Form 2023 Vehicle Sales Tax Exemption Missouri generally, missouri taxes all retail sales of tangible personal property and certain taxable services. according to the sales tax handbook, the state of missouri imposes a 4.225 percent state general sales tax rate on the. There aren’t any explicit exemptions to the sales tax on vehicles in. are there exemptions from missouri’s car tax? the state. Vehicle Sales Tax Exemption Missouri.

From www.formsbank.com

Missouri Department Of Revenue Form Form 149 Sales/use Tax Vehicle Sales Tax Exemption Missouri generally, missouri taxes all retail sales of tangible personal property and certain taxable services. the state imposes a 4.225% sales tax on all car purchases, and there might be an extra local tax of up to 4.5%. according to the sales tax handbook, the state of missouri imposes a 4.225 percent state general sales tax rate on. Vehicle Sales Tax Exemption Missouri.

From www.signnow.com

Missouri Sales Tax Form 53 1 Instruction Fill Out and Sign Printable Vehicle Sales Tax Exemption Missouri use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. generally, missouri taxes all retail sales of tangible personal property and certain taxable services. are there exemptions from missouri’s car tax? the state imposes a 4.225% sales tax on all car purchases, and there might. Vehicle Sales Tax Exemption Missouri.

From www.exemptform.com

Missouri Farm Taxexempt Form Vehicle Sales Tax Exemption Missouri according to the sales tax handbook, the state of missouri imposes a 4.225 percent state general sales tax rate on the. generally, missouri taxes all retail sales of tangible personal property and certain taxable services. are there exemptions from missouri’s car tax? the state imposes a 4.225% sales tax on all car purchases, and there might. Vehicle Sales Tax Exemption Missouri.

From sherigratiana.pages.dev

State Of Ohio Sales Tax Exempt Form 2024 Cally Corette Vehicle Sales Tax Exemption Missouri according to the sales tax handbook, the state of missouri imposes a 4.225 percent state general sales tax rate on the. the state imposes a 4.225% sales tax on all car purchases, and there might be an extra local tax of up to 4.5%. There aren’t any explicit exemptions to the sales tax on vehicles in. are. Vehicle Sales Tax Exemption Missouri.

From www.templateroller.com

Form 5095 Fill Out, Sign Online and Download Fillable PDF, Missouri Vehicle Sales Tax Exemption Missouri according to the sales tax handbook, the state of missouri imposes a 4.225 percent state general sales tax rate on the. are there exemptions from missouri’s car tax? generally, missouri taxes all retail sales of tangible personal property and certain taxable services. There aren’t any explicit exemptions to the sales tax on vehicles in. the state. Vehicle Sales Tax Exemption Missouri.

From www.signnow.com

5060 Form Complete with ease airSlate SignNow Vehicle Sales Tax Exemption Missouri There aren’t any explicit exemptions to the sales tax on vehicles in. according to the sales tax handbook, the state of missouri imposes a 4.225 percent state general sales tax rate on the. generally, missouri taxes all retail sales of tangible personal property and certain taxable services. generally, missouri taxes all retail sales of tangible personal property. Vehicle Sales Tax Exemption Missouri.

From poppynolan.z13.web.core.windows.net

Missouri Tax Exempt Form Vehicle Sales Tax Exemption Missouri generally, missouri taxes all retail sales of tangible personal property and certain taxable services. generally, missouri taxes all retail sales of tangible personal property and certain taxable services. according to the sales tax handbook, the state of missouri imposes a 4.225 percent state general sales tax rate on the. There aren’t any explicit exemptions to the sales. Vehicle Sales Tax Exemption Missouri.

From www.formsbank.com

Fillable Motor Vehicle Sales Tax Exemption Certificate printable pdf Vehicle Sales Tax Exemption Missouri the state imposes a 4.225% sales tax on all car purchases, and there might be an extra local tax of up to 4.5%. generally, missouri taxes all retail sales of tangible personal property and certain taxable services. generally, missouri taxes all retail sales of tangible personal property and certain taxable services. use the tax calculator to. Vehicle Sales Tax Exemption Missouri.

From www.templateroller.com

Form 1746 Download Fillable PDF or Fill Online Missouri Sales or Use Vehicle Sales Tax Exemption Missouri generally, missouri taxes all retail sales of tangible personal property and certain taxable services. are there exemptions from missouri’s car tax? the state imposes a 4.225% sales tax on all car purchases, and there might be an extra local tax of up to 4.5%. There aren’t any explicit exemptions to the sales tax on vehicles in. Web. Vehicle Sales Tax Exemption Missouri.

From startup101.com

How To Get A Missouri Sales Tax Exemption Certificate StartUp 101 Vehicle Sales Tax Exemption Missouri use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. There aren’t any explicit exemptions to the sales tax on vehicles in. are there exemptions from missouri’s car tax? according to the sales tax handbook, the state of missouri imposes a 4.225 percent state general sales. Vehicle Sales Tax Exemption Missouri.

From www.exemptform.com

Missouri Sales Tax Exemption Form 1746 Vehicle Sales Tax Exemption Missouri generally, missouri taxes all retail sales of tangible personal property and certain taxable services. the state imposes a 4.225% sales tax on all car purchases, and there might be an extra local tax of up to 4.5%. There aren’t any explicit exemptions to the sales tax on vehicles in. generally, missouri taxes all retail sales of tangible. Vehicle Sales Tax Exemption Missouri.

From legaltemplates.net

Free Missouri Trailer Bill of Sale Template PDF & Word Legal Templates Vehicle Sales Tax Exemption Missouri use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. There aren’t any explicit exemptions to the sales tax on vehicles in. according to the sales tax handbook, the state of missouri imposes a 4.225 percent state general sales tax rate on the. the state imposes. Vehicle Sales Tax Exemption Missouri.

From freeforms.com

Free Missouri (DMV) Bill of Sale Form for Motor Vehicle, Trailer, or Vehicle Sales Tax Exemption Missouri the state imposes a 4.225% sales tax on all car purchases, and there might be an extra local tax of up to 4.5%. generally, missouri taxes all retail sales of tangible personal property and certain taxable services. There aren’t any explicit exemptions to the sales tax on vehicles in. according to the sales tax handbook, the state. Vehicle Sales Tax Exemption Missouri.

From www.signnow.com

Missouri Tax Exemption Renewal Form Fill Out and Sign Printable PDF Vehicle Sales Tax Exemption Missouri generally, missouri taxes all retail sales of tangible personal property and certain taxable services. the state imposes a 4.225% sales tax on all car purchases, and there might be an extra local tax of up to 4.5%. use the tax calculator to estimate the amount of tax you will pay when you title and register your new. Vehicle Sales Tax Exemption Missouri.

From www.exemptform.com

Wv Sales Tax Exemption Form 2023 Vehicle Sales Tax Exemption Missouri generally, missouri taxes all retail sales of tangible personal property and certain taxable services. generally, missouri taxes all retail sales of tangible personal property and certain taxable services. There aren’t any explicit exemptions to the sales tax on vehicles in. are there exemptions from missouri’s car tax? use the tax calculator to estimate the amount of. Vehicle Sales Tax Exemption Missouri.

From www.templateroller.com

OTC Form 70131 Fill Out, Sign Online and Download Fillable PDF Vehicle Sales Tax Exemption Missouri generally, missouri taxes all retail sales of tangible personal property and certain taxable services. There aren’t any explicit exemptions to the sales tax on vehicles in. the state imposes a 4.225% sales tax on all car purchases, and there might be an extra local tax of up to 4.5%. generally, missouri taxes all retail sales of tangible. Vehicle Sales Tax Exemption Missouri.

From old.sermitsiaq.ag

Printable Tax Exempt Form Vehicle Sales Tax Exemption Missouri the state imposes a 4.225% sales tax on all car purchases, and there might be an extra local tax of up to 4.5%. There aren’t any explicit exemptions to the sales tax on vehicles in. are there exemptions from missouri’s car tax? according to the sales tax handbook, the state of missouri imposes a 4.225 percent state. Vehicle Sales Tax Exemption Missouri.